Join our Weekly Newsletter!

Ethical ETFs for ESG Investors

This may sound familiar: You’re ready to invest, but you want to avoid putting your money into companies that don’t match your values. You’ve heard a lot about environmental, social, and governance (ESG) investing, but you’re unsure if it’s possible to invest ethically without hurting your financial returns. Sound familiar?

Here’s the good news—ethical investing isn’t just a niche anymore. In 2024, more investors are looking for ways to grow their wealth and do some good. But the big question is: Can you stay true to your values and still make solid returns?

That’s where ethical ETFs (Exchange Traded Funds) come in. They let you invest in a way that aligns with your principles, supporting companies that meet certain ESG criteria. And the best part? You don’t have to sacrifice your financial goals to do it.

In this post, you’ll learn why ethical ETFs are getting more popular with ESG investors and how they compare financially to traditional ETFs. By the end, you’ll see why investing in ethical ETFs could be a smart move for your portfolio and the planet in 2024.

What Are Ethical ETFs?

Ethical ETFs, or Exchange Traded Funds, are essentially bundles of stocks or bonds that meet specific Environmental, Social, and Governance (ESG) criteria.

These funds are designed to invest in companies that prioritize sustainable practices, social responsibility, and ethical governance while avoiding industries or companies that don’t align with these values, such as fossil fuels, tobacco, or arms manufacturing.

The main difference between ethical and traditional ETFs is in the selection process. Traditional ETFs might include any companies, regardless of their environmental or social impact, as long as they’re financially strong.

On the other hand, ethical ETFs apply a filter—choosing only companies that meet certain ethical standards, whether reducing carbon footprints, treating employees fairly, or maintaining transparent governance practices.

For investors who care about where their money is going, ethical ETFs offer a way to invest in a diversified portfolio without compromising on values. They provide exposure to multiple companies across industries, all while ensuring that your investments reflect the issues you care about most—sustainability, human rights, or corporate transparency.

The Financial Performance of Ethical ETFs

One of the biggest questions ESG investors often have is: “Can ethical ETFs match up to traditional ETFs in terms of returns?” The short answer is—yes, they can, and in many cases, they do.

In recent years, ethical ETFs have shown that doing good and earning strong financial returns aren’t mutually exclusive. Many ethical funds have delivered competitive performance, with some even outperforming traditional ETFs.

Why? Because more consumers and investors are favoring companies with sustainable practices, which in turn pushes these businesses to succeed in the long run. Companies that focus on ESG factors are often better at managing risks, staying compliant with regulations, and maintaining strong reputations—leading to financial stability.

While there’s always some debate about whether ethical ETFs will consistently outperform, we’ve seen a clear shift in the last few years. Investors are increasingly aware of the risks of ignoring ESG issues, such as regulatory fines or reputational damage. These factors can negatively affect traditional companies that don’t prioritize sustainability, making ethical ETFs a safer long-term bet in certain markets.

So, when you invest in an ethical ETF, you’re not just putting your money where your values are—you’re also betting on companies that are likely to be more resilient in the future. And that’s a win-win for both your conscience and your wallet.

Why Ethical ETFs Make Sense for ESG Investors in 2024

2024 is a big year for ethical investing, and ethical ETFs are right at the centre of it all. Here’s why they’re a smart choice for ESG investors now:

- More People Want Sustainable Investments

People are paying more attention to where their money goes. Companies are being pushed to improve their environmental and social impact, and ethical ETFs are riding this wave. Businesses that care about sustainability and social responsibility are thriving, making them a great choice for investors who want solid returns and to make a difference. - Stricter Rules on ESG

Governments are stepping in with new regulations that force companies to clean up their act when it comes to sustainability and transparency. Companies that already meet these high standards—like those in ethical ETFs—are in a great position to succeed as these rules get tougher. - Stronger During Tough Times

Companies that do well on ESG factors tend to handle risks better, whether it’s climate change or workplace issues. This means that ethical ETFs, which invest in these companies, can be more stable when the market gets shaky. If you’re looking for investments that can weather the storm, ethical ETFs are a solid option. - Investing in Your Values

Ethical ETFs let you put your money where your values are. Whether you care about the environment, human rights, or diversity, these funds allow you to support companies making real change. In 2024, as the world focuses even more on sustainability, this approach makes more sense than ever.

So, ethical ETFs offer the best of both worlds: they let you invest in companies that are doing good things while still aiming for financial growth. It’s a win-win.

How to Choose the Right Ethical ETF

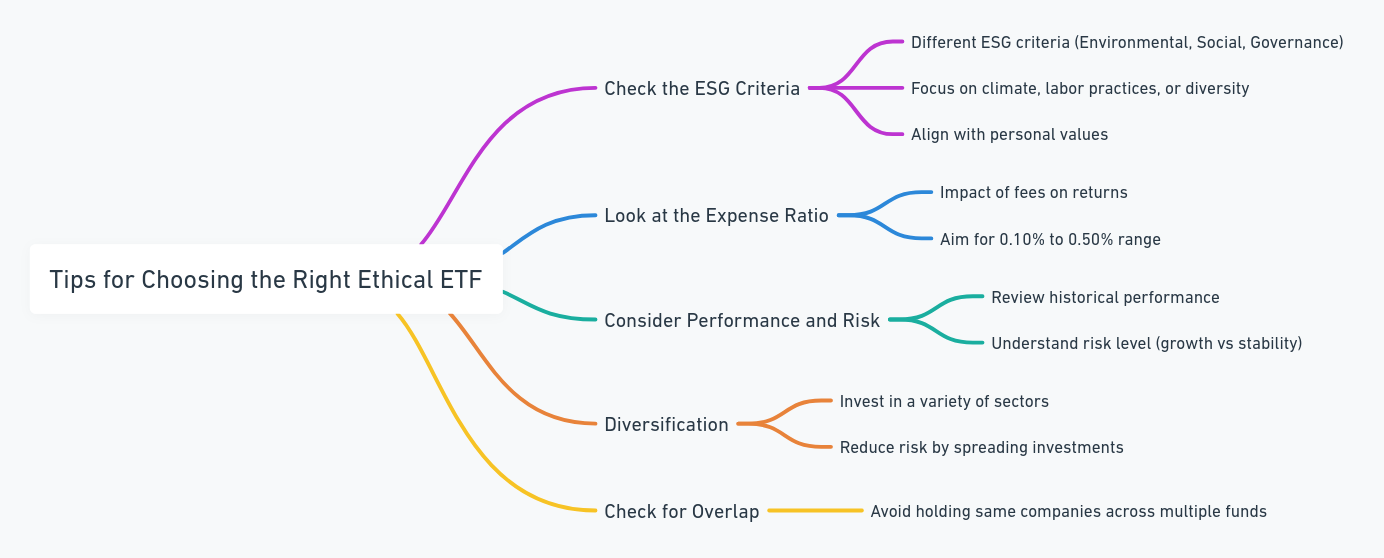

Choosing the right ethical ETF can feel overwhelming, but it doesn’t have to be. Here are a few simple tips to help you pick one that fits your values and financial goals:

- Check the ESG Criteria: Not all ethical ETFs are the same. Each uses different ESG (Environmental, Social, and Governance) criteria to decide which companies make the cut. Some funds might focus on climate-friendly companies, while others prioritize fair labor practices or diversity. Make sure the ETF you pick aligns with what matters most to you.

- Look at the Expense Ratio: Just like with any investment, fees matter. The expense ratio tells you how much the fund charges annually to manage your money. A lower expense ratio means more of your money stays invested. Look for ethical ETFs with reasonable fees—usually around 0.10% to 0.50%—so you don’t lose too much of your returns to management costs.

- Consider Performance and Risk It’s important to review the historical performance of the ETF and understand how it has fared over time. While past performance doesn’t guarantee future returns, it can give you a sense of how the fund performs in different market conditions. Also, the risk level of the ETF should be checked. Some ethical ETFs are more focused on growth and might be riskier, while others are designed to be more stable.

- Diversification: A good ETF should be well-diversified, meaning it invests in various industries or sectors. This helps reduce risk because you’re not relying too heavily on one company or industry. Ethical ETFs can focus on everything from clean energy to tech, so choose one that spreads your investments across different sectors.

- Check for Overlap: If you already have other investments, be mindful of any overlap. Some ethical ETFs might hold the same companies you already invested in through other funds, which can reduce the benefits of diversification.

For a list of top-performing ethical ETFs, make sure to check out our

curated list here, which will help you get started with your search.

Conclusion

Ethical ETFs are a powerful way to invest in 2024, combining financial growth with positive change. Whether driven by environmental concerns, social justice, or ethical governance, these funds allow you to invest in companies that align with your values.

And the best part? You don’t have to give up financial returns to do it.

With rising demand for sustainable investments, tougher regulations, and strong long-term potential, ethical ETFs are well-positioned to perform. By choosing the right fund, you can support companies that are making a difference while working towards your financial goals.

Frequently Asked Questions

-

1. What exactly is an ethical ETF?

Ethical ETF GuideAn ethical ETF is a fund that invests in companies meeting specific environmental, social, and governance (ESG) standards. It avoids industries like fossil fuels or tobacco and focuses on businesses that are more sustainable and socially responsible.

-

2. Do ethical ETFs perform as well as traditional ETFs?

Green Investing GuideYes, many ethical ETFs have been matching or even outperforming traditional ETFs in recent years. They invest in companies that are often more resilient and better at managing risks, making them solid options for both ethical and financial returns.

-

3. How do I choose the right ethical ETF?

$5 Investment BonusLook at factors like the ESG criteria, expense ratio (fees), historical performance, and how diversified the fund is. Make sure the companies in the ETF reflect your values and that the fees are reasonable.

-

4. Are ethical ETFs safe for long-term investing?

Best Long-Term ETFsEthical ETFs can be a good long-term investment. They focus on companies that are forward-thinking and manage risks well, making them a stable option in uncertain markets. However, like all investments, they still carry some risk.

QUICK LINKS

Join Newsletter

Join Grow Your Pennies

We will get back to you as soon as possible.

Please try again later.

All Rights Reserved | PennyPillars | Powered by Webssentials